"SK Networks Continues Impressive Growth, Expects Clear Skies for Second Half of the Year"

Strong Performance in Q1 and Q2 Fueled by Strategic Investments and Rental Business Success

SEOUL (News2day) - SK Networks, led by CEO Lee Ho-jung, has maintained its remarkable growth trajectory throughout the first half of the year and is poised for a positive outlook in the latter half.

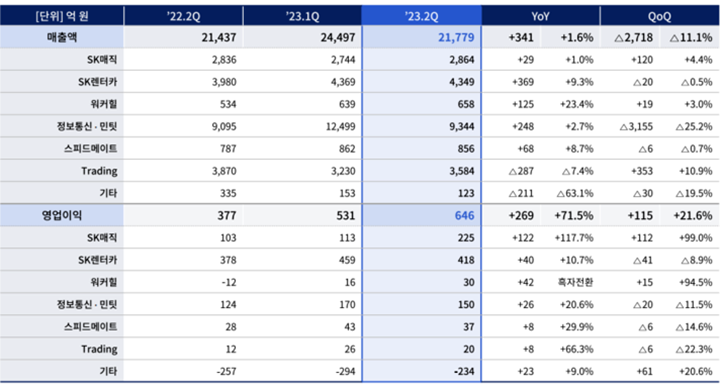

According to industry insiders, SK Networks reported a noteworthy 22.6% increase in operating profit for Q1, recording 531 billion KRW compared to the previous year's 433 billion KRW. Similarly, in Q2, the operating profit surged to 646 billion KRW, marking a remarkable 71.5% growth compared to 377 billion KRW of the same period in the previous year.

At the start of this year, SK Networks unveiled an ambitious goal to transform into a "business-oriented investment company," streamlining its focus on both "business" and "investment" directions.

Consequently, the company attributes its strong performance in the first half of the year to its diverse investments and acquisitions, aligning with this vision.

The standout contributor to these successes has been the "rental" business.

In Q2, SK Networks announced that both SK Magic and SK Rent-a-car, the two subsidiaries representing the rental business, had simultaneously achieved substantial growth in their financial results.

SK Networks had acquired SK Magic (formerly Dongyang Magic) for around 600 billion KRW in 2016. Two years later, in 2018, it acquired SK Rent-a-car (formerly AJ Rent-a-car) for approximately 300 billion KRW.

Since then, these subsidiaries have started to fulfill their roles as cash cows for SK Networks.

Indeed, examining SK Networks' Q2 performance reveals that the operating profits of SK Magic, which handles home appliance rentals, and SK Rent-a-car, specializing in vehicle rentals, reached 225 billion KRW and 418 billion KRW, respectively. These figures represent a significant increase of 118% and 10% each from the same period last year.

Additionally, in terms of market share, SK Magic secured the second position (15%) in the domestic rental market, and SK Rent-a-car also held the second spot with a 17.3% share.

SK Networks attributes SK Magic's success to the consumer reception of new products like the "One Coke Ice Water Purifier," the "Plus Direct Tap Water Purifier," and the "New Slim Water Purifier." The company also increased online channel sales and continued efforts to enhance profitability by reducing costs.

Likewise, SK Rent-a-car maintained a steady income stream with a focus on long-term rentals. Services tailored to customers, such as the "SmartLink" vehicle operation management solution and the "TagoBuy" used car long-term rental product, gained popularity.

Moreover, diversifying the export routes for used cars contributed to sustained growth in operating profit.

An SK Networks representative stated, "In Q2 of this year, the operating profit of the rental business greatly outperformed other business sectors of SK Networks, including Information and Communications (150 billion KRW), Speedmate (37 billion KRW), Walkerhill (30 billion KRW), and Trading (20 billion KRW)."

Market experts praised SK Networks, noting that since Q1 2018, following the inclusion of one-time factors from SK Magic, the company has consistently posted its highest profits. They emphasized that all business sectors have entered a stable phase, with rental operations particularly normalized, signifying a positive shift.

Expanding Investments in Promising Fields for the Future SK Networks, with a growing focus on promising future sectors, plans to expand its investments in the upcoming period.

As SK Networks solidifies its position as a business-oriented investment company, it has been progressively investing in various domestic and international promising tech firms, including hyper-scale data centers, AI-based device startup 'HUMAIN,' unmanned tractor automation solution firm 'Savanto,' and smart farm startup 'Source.ag' since 2020. The company also discussed collaboration with OpenAI's CEO, Sam Altman, in June.

These investment endeavors demonstrate SK Networks' ambitions to become a data-centric company.

Global data industry growth has averaged 12% annually from 2018 to 2022, according to the European Commission. It is projected to increase even further, reaching 13% by 2030. Similarly, the Korean Data Agency forecasts an average annual growth rate of 13% in the domestic market until 2028, suggesting a promising future.

In line with this, SK Networks made a decision to acquire "Encoa," a domestic leader in data management, to lead the domestic data management market. The rationale behind this move is the growing importance of unseen data management businesses in various industries, as companies increasingly leverage data.

Encoa, founded in 1997, specializes in data management consulting and solutions for various partner companies. It offers nine solutions covering various aspects of data management, including modeling, metadata, and quality management. The company has secured over 500 clients across industries such as telecommunications, finance, and mobility.

SK Networks evaluated Encoa's potential for growth highly and approved the acquisition of an 88.47% stake (213,304 shares) for 884.7 billion KRW during a board meeting on the 21st.

Consequently, SK Networks is expected to capitalize on synergies, setting up integrated data infrastructure among its main office, SK Rent-a-car, SK Magic, SK Electric Link, and others. This development also paves the way for generating AI-based results and additional investment opportunities on the back of substantial data.

A market expert stated, "Encoa's integration with SK Networks' subsidiaries, including SK Rent-a-car and SK Magic, will enhance the existing business model," and "this will likely lead to the emergence of new businesses through synergies."

An SK Networks representative stated to News Today, "Through our efforts to align business and investment directions and drive business transformation, both our main company and subsidiary businesses are reaping the rewards." They further added, "In the latter half of this year, we will continue to flexibly respond to changes in the business environment, strengthen our investment portfolio with high corporate competitiveness, and increase corporate value."

By Ryunjoo Kang, a reporter of News2day / fbswn00@news2day.co.kr

댓글 (0)

- 띄어 쓰기를 포함하여 250자 이내로 써주세요.

- 건전한 토론문화를 위해, 타인에게 불쾌감을 주는 욕설/비방/허위/명예훼손/도배 등의 댓글은 표시가 제한됩니다.