“Low-Cost Carriers (LCCs) Edge Out FSCs and Foreign Airlines in International Route Competition“

2023 Marks a Pivotal Year as LCCs Outperform Full-Service Carriers in International Markets

SEOUL (news2day) -The year 2023, marked by the full onset of the COVID-19 pandemic, is witnessing the heyday of Low-Cost Carriers (LCCs), heralding a new era in the aviation industry.

As of the third quarter of this year, major Full-Service Carriers (FSCs) have experienced an increase in revenue but a decrease in operating profits. In contrast, LCCs have achieved their best performance to date.

Notably, LCCs have demonstrated outstanding results in the international sector this year, surpassing Full-Service Carriers such as Korean Air and Asiana Airlines in international passenger market share.

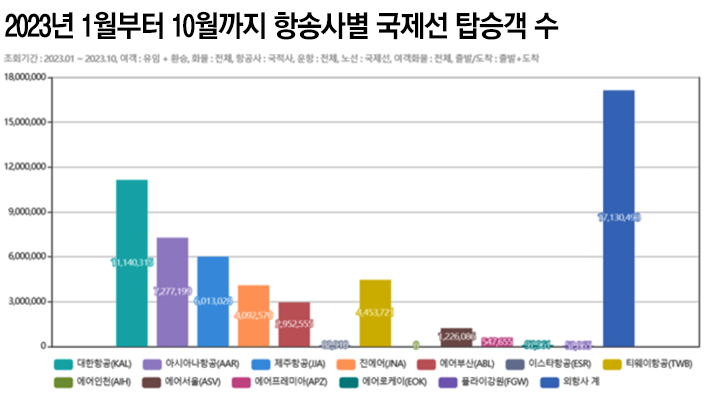

According to the aviation statistics from the Ministry of Land, Infrastructure and Transport, the number of international passengers from January to October was 55 million.

Among them, Korean Air and Asiana Airlines accounted for a total of 18 million, with 11 million and 7.2 million, respectively, representing 33.45% of the total international passengers.

In comparison, the international passenger count for the nine domestic LCCs was 19.5 million, constituting 35.45% of the total. In terms of passenger share, this is 2%P higher than the FSCs.

The top three LCCs are Jeju Air, T'way Air, and Jin Air, with passenger counts of 6 million, 4 million, and 2.9 million, respectively.

Until the outbreak of the COVID-19 pandemic in 2019, LCCs had been expanding their presence in the international sector. The percentage of total international passengers for LCCs steadily increased over the years: 9.63% in 2013, 11.48% in 2014, 14.60% in 2015, and 12.28% in 2016. Subsequently, it reached the 30% range with 26.38% in 2017, 29.17% in 2018, and 29.47% in 2019.

While LCCs experienced a decline from 2020 amid the COVID-19 pandemic, dropping to 6.46% in 2021, they have rebounded in 2022.

LCCs attribute their successful international performance this year to the popularity of "short-haul routes." Industry insiders state that the activation of routes to Japan and Southeast Asia, known as strengths for LCCs, played a significant role.

Another industry source mentioned a shift in travel trends post-COVID-19, stating, "The pandemic has ended, and travel trends have changed. Many now prefer shorter trips abroad rather than long-distance travel, benefiting LCCs."

Jeju Air's analysis of international passenger demand from January to June this year revealed that out of 2.66 million round-trip ticket purchasers, 54.8% (1.46 millions) traveled for 3 to 4 days. Among them, 20.8% (0.3 million) chose routes to Vietnam, the Philippines, Thailand, and other Southeast Asian destinations.

The most popular destination by route was Japan, with 1 million, reaching 70.3% of the 2.66 million round-trip ticket purchasers.

In response, LCCs are intensively competing to expand their short-haul routes. Jeju Air increased its international routes from 26 in Q3 of the previous year to 55 in Q3 of this year. In June, it introduced new flights three times a week on the Incheon-Oita route, followed by new routes in July (Incheon-Hiroshima) and December (Incheon-Da Nang).

Jeju Air is set to launch new flights seven times a week on the Incheon-Da Nang route starting from December 20, 2023.

During the summer peak season, Jeju Air expanded operations on popular routes to Japan, Southeast Asia, and Oceania. Depending on the route, the number of flights increased, such as Incheon-Sapporo from 120 to 186, Incheon-Fukuoka from 300 to 310, Incheon-Tokyo (Narita) from 326 to 336, and Busan-Tokyo (Narita) from 78 to 86, totaling 760 additional flights.

Similarly, T'way Air expanded its international network by introducing new routes from Cheongju Airport to Da Nang, Bangkok, Osaka, Nha Trang, and Yeosu starting from early this year. T'way Air increased its routes from regional airports to absorb non-capital area passenger demand.

T'way Air explained that these efforts contributed to the actual increase in performance. According to T'way Air, from January to October this year, 223,660 who traveled abroad through T'way Air from Cheongju Airport accounted for about 80% of the total international passengers at Cheongju Airport, which was over 278,900.

Jin Air also expanded its international network by introducing new routes from Busan to Nha Trang in July, Incheon to Nagoya in September, and planning new routes from Busan to Taipei and Incheon to Phu Quoc in December, continuing to expand its international route network.

The continued expansion of short-haul routes ultimately enables more efficient operation of aircraft, allowing for the transportation of more passengers. An industry insider explained, "The number of passengers is proportional to the supply of passenger planes. LCCs frequently travel short distances, while FSCs, considering long-haul flights, naturally have fewer passengers."

If the trend of LCCs expanding their international presence continues in the fourth quarter, LCCs are expected to surpass FSCs in annual international passenger numbers for the first time since their inception in 2003. The aviation industry is closely watching developments in the fourth quarter.

By Soyeong Jeon/ jsy@news2day.co.kr

댓글 (0)

- 띄어 쓰기를 포함하여 250자 이내로 써주세요.

- 건전한 토론문화를 위해, 타인에게 불쾌감을 주는 욕설/비방/허위/명예훼손/도배 등의 댓글은 표시가 제한됩니다.